1.

INTRODUCTION

Development of Agricultural Land

Market is unique in Russia as compared to other countries. The

abolition of serfdom in 1861 and Stolypin’s Reform as well as

subsequent development of Agricultural Land Market undermined the

communal land system. The super goal of modern Russian Agrarian and

Land Reform is to create the conditions and incentives to provide

sustainable development of agricultural production and to solve the

country's food problem. It should be noted that one of the specific

objectives of the reform is the

redistribution of land from collective to private farming in order

to provide rational use and protection of lands in Russia.

The state’s land

monopoly in Russia was abolished and two main forms of

land ownership: public uses and private farming were introduced.

Land may be converted into individual private property

of citizens for personal use, farming, horticulture, and animal

husbandry as well as to accommodate buildings and constructions for

individual enterprise, to build and maintain dwelling houses,

country cottages, garages.

The private property may be

established also as the result of the conversion of lands belonged

to former collective and state farms as well as joint-stock

companies including those established on the

basis of state farms and other state-owned enterprises, and lands

granted for collective horticultural production, animal

husbandry, and collective country-house construction.

The principle of independent

agricultural production by land proprietors, landowners, and tenants

has been secured. Any interference in their activity by state,

economic or other bodies is prohibited. The economic, social, and

legal basis for the organization and activity of private farms and

coops on the territory of Russia has been determined. The rights of

citizens to organize private farms, economic independence,

assistance, state protection of their legitimate interests and the

right to free cooperation have been guaranteed.

It is proclaimed that a

private farm should be an independent economic entity having the

rights of a legal subject, which produces, processes, and sells

agricultural products. Parcels of land may be leased by local

authorities or citizens who are land proprietors. This was the first

time in Russia of a right is available to divide and reform

collective and state farmland into shares.

Member of former collective

farm or state farm has the right to withdraw and start up a

farmstead of his own without asking for

consent of collective or the management. Upon decision by local

authorities, such a farmstead is granted a piece of land of a size

corresponding to the farmstead member’s share in the land stock or

value.

A withdrawing

farmer may expand his land possessions by purchase. During the

reorganization of collective and state farms, these farms were

broken up into smaller units and their juridical status was made

consistent with legislation of the Russian Federation.

2. LAND TENURE

The Russian

Federation’s territory was amounted 1,709.8 million hectares in

2009. The most important piece of the area is agricultural

land. The total agricultural land area was estimated 400.0 million

hectares in 2009 or 23.4 % of the total Russian Federation area (see

Table 1).

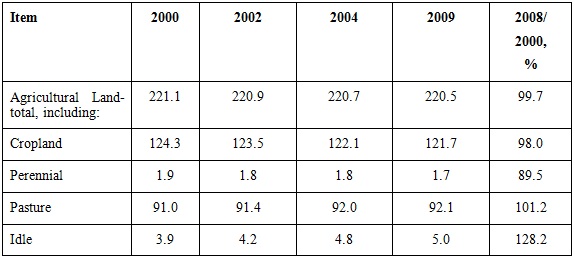

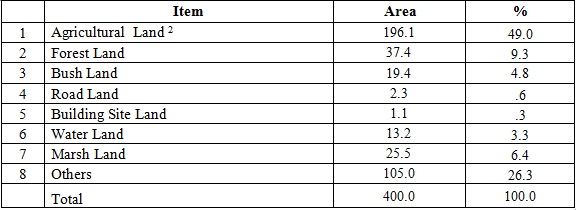

The cropland,

perennial, pastures, hay field lands as well as idle land were

amounted 196.1 million hectares or 49.0 % of total agricultural land

area in 2009 (see Table 2).

Table 2. Agricultural Land, Russian

Federation, 2009, million hectares

Source: Rosnedvizhimost’, 2010.

Includes: cropland, perennial, pasture, hay field land as

well as idle land.

Source: Russian National Economy Fact Book 2008 (Rossija v tsifrakh,

2008) Moscow, Federal Service of State Statistics, 2008, p.238.

3. LEGAL FRAMEWORK

The legal framework for Land Market must be also improved. There are

some contradictions between basic legal acts (the Constitution of

the Russian Federation, the Civil Code, the Land Code, The Federal

Mortgage Act, the Agricultural Land Market Act, the Federal State

Registration of the Rights to Real Estate Act, and etc.) related to

regulation of Agricultural Land Market. Due to it, despite of

adoption the Land Code as well as the Agricultural Land Market Act

the legal basis for implementation of Agricultural Land Market is

still unclear.

Both the Russian Constitution, adopted in 1993, and the Civil Code,

adopted in 1994, upholds the right to own private property, which

includes both land plots and buildings. Despite these guarantees,

however, land reform was for a long time the subject of national

political debate. The general principles of land ownership are set

out in the Constitution. Article 9 of the Constitution establishes

the principle of private ownership of land. However, it does not

provide any procedure for the transfer of land, historically owned

by the state, into private ownership.

The Land Code approved by the State Duma in 2001 has limited

applicability to some categories of land, which are the subject of

the separate federal laws. Such land includes water, forestland as

well as agricultural land. According to the Land Code, the

Agricultural Land Market Act governs the agricultural land market

transactions. Thus, in fact, the Land Code applies only to

non-agricultural land, which covers about just two percents of the

total Russian land area.

In accordance with the Agricultural Land Market Act, the Federal

Mortgage Act governs the agricultural land mortgage transactions.

The Farm Credit System as well as Agricultural Land Mortgage Bank

must be introduced to provide an access for farmers to agricultural

credit and to guarantee them the right to use their land as well as

other real estate as collateral.

Thus, the Russian Land and Real Estate legislation must be revised

to eliminate the substantial contradictions existing between

different laws now. Due to it some substantial changes have been

made in Agricultural Land Market Act as well as the Federal Land Use

Planning Act on July 18, 2005 by the State Duma. According to them

land shares belonged to former collective and state farmers must be

demarcated on the ground as well as their location must be

determined. In our opinion it will positively affect on development

of Agricultural Land Market in the Russian Federation. But the

legislation must be amended to enable Land Market and ensure clear

delineation of the corresponding property rights among the various

level of the government. In 2001 the Federal Separation The State

Ownership On Land Act ( Zakon o razgranichenii gosudarstvennoy

sobstvennosti na zemlyou) was adopted by the State Duma. According

to the Agricultural Land Market Act the Regional Agricultural Land

Markets Acts were introduced at the regional level.

In accordance with article 8 of the Land Code The Land

Transformation Act (Zakon o perevode zemel i zemelnykh uchastkov iz

odnoy kategorii v druguyou) has been adopted on December 21, 2004.

According to the Law the land transformation procedure has been

introduced and clarified. According to the Law the Forest Code as

well as Federal Ecological Expertise Act has been changed. On

January 1, 2006 the Land Taxation Act was abolished and new chapter

# 31 of the Russian Tax Code “Land Taxation” was introduced.

According to the chapter the Land Taxation is exclusive

responsibility of local governments.

In that sense it’s very important to make cadastre information more

understandable and transparent for customers. It must be pointed out

that so called ”cadastral value” of agricultural land using in

Russia is not applicable for Agricultural Land Taxation as well as

Agricultural Land Market because there is no relation to market land

value. As a result, Russian banks have not accepted “cadastral

value” as a basis for Agricultural Land Mortgage transactions (see

Table 5).Because of it, outside investors as well as other customers

are not being able to get reliable information about the value of

agricultural land plots and participate as educated and

well-informed market agents (buyers or sellers) in Agricultural Land

Market transactions.

Despite of it, a new Land Taxation System based on so called

“cadastral value “was adopted by the Russian Parliament in November,

2004. According to it the maximum Agricultural Land Tax Rate defines

as 0.3% of “cadastral value” of agricultural land. But a new

Cadastre Value Methodology based on Market Economy principles has

been developed.

On July 24, 2007 the State Real Estate Cadastre Act (Zakon o

gosudarstvennom kadastre nedvizhimosti) was issued. According to the

Law the State Real Estate Cadastre was introduced on March 1, 2008.

The Law governs the Real Estate Cadastre Survey Activities as well

as collection, processing and usage of Real Estate Cadastre

Information. In accordance with p.2 of article 1 of the Law the

State Real Estate Cadastre is a registered record that shows the

ownership, boundaries, and values of land and buildings. Such

register shows the owner of each parcel of land, its area, its use

and category, buildings as well as their fiscal assessment. In

accordance with p.5 of article 1 of the Law the land plots,

buildings and other property are the subjects of the Real Estate

Cadastral Survey.

The Agricultural Land Market Act as well as some other land acts was

amended on December 29, 2010 by the special federal law #435. The

order of compulsory withdrawal of sites of agricultural appointment

was settled. According to the Law it’s possible through court in a

case when the land isn't used 3 years and more, and also at

essential decrease in fertility or considerable deterioration of

ecological conditions. Signs of non-use and criteria of decrease in

fertility (ecology deterioration) will be defined by the Government

of the Russian Federation. Administrative responsibility for non-use

of the agricultural lands to destination is strengthened. A number

of amendments is directed on perfection of a turn of the land shares

received at privatization of agricultural lands. So, the transfer

order (without tendering) municipal sites in the property or rent to

the agricultural organizations and farmers, their using is

simplified. The price of such land can't exceed 15 %, and a rent -

.3 % of its cadastral value. Features of formation of sites from the

lands of agricultural appointment, fulfillment of transactions with

land shares are established. The order of the termination of the

rights to unclaimed land shares is settled. As those of what the

proprietor hasn't disposed within 3 years (except those, in

particular, are considered, the rights on which are registered).

Possibility of disclaimer of the property on a land share is

provided. The law comes into force since July, 1st, 2011, except for

separate positions for which other terms of conducting in action are

provided.

4. INSTITUTIONAL FRAMEWORK

The main objective of the Russian Government policy in the area of

Real Estate is to create conditions for efficient use and

development of Real Estate Market meeting the requirements of

society and individual citizens.

On December 25, 2008 in accordance with the President of the Russian

Federation Decree on Federal Service of State Registration, Cadastre

and Mapping the Federal Service of Real Estate Cadastre as well as

Federal Agency of Geodesy and Mapping were dissolved. According to

the Decree the Federal Registration Service was renamed into Federal

Service on State Registration, Cadastre and Mapping (Rosreestr). The

functions of mentioned above agencies were transferred to Rosreestr.

The Federal Service on State Registration, Cadastre and Mapping is

now under authority of Ministry of Economic Development

(Ministerstvo ekonomicheskogo razvitiya) of the Russian Federation.

At regional level local offices of former Federal Service of Real

Estate Cadastre as well as Land Cadastre Chambers have been

transferred to Federal Service on State Registration, Cadastre and

Mapping.

5. REGIONAL LAND POLICIES

Development of Agricultural Land Market in the Russian Federation is

mostly depended on Regional Land Policies. One of the successful

examples is Orel Region Land Policy which based on legal framework

included the Federal Legislation as well as local regulations.

Orel Oblast Land Legislation is based on the following acts: Decree

of the Head of Administration of Orel Oblast # 616 issued on

December 12, 1997 on farm reorganization and land privatization and

Target Program on development of the Legal Basis of Orel Oblast Land

Reform approved by the regional authorities on October 10, 1998. The

Land Policy is the main part of Orel Regional Government

Agricultural Policy included the following components: farm

reorganization and land privatization, horizontal and vertical

cooperation as well as integration of agricultural producers,

development of innovation and investment activities in agriculture,

development of Regional Agricultural Land Market.

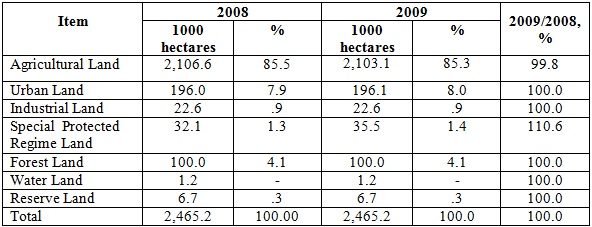

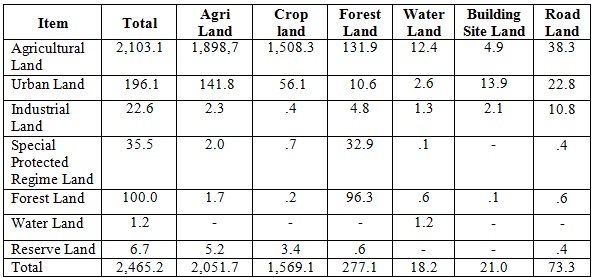

Orel region agricultural land was amounted 2,103.1 thousand hectares

or 85.3 % of total regional land in 2009 (see Table 8). Break down

of Orel Oblast Land is displayed in Table 9.

Table 8. Orel Oblast Land, 2008-2009

Source: Orelnedvizhimost’, 2010.

Table 9. Break down of Orel Oblast Land, 2009,

1000 hectares

Source: Orelnedvizhimost’, 2010.

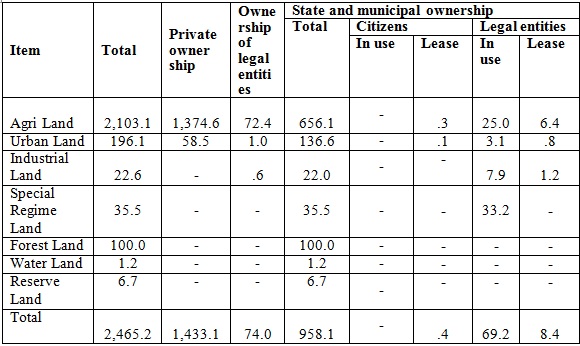

The private land ownership plays the dominant role in the

regional agriculture and consists mostly of land shares belonged to

former collective and state farmers (see Table 10).

Table 10. Land Tenure, Orel Oblast, 2009, 1000

hectares

Source: Orelnedvizhimost’, 2010.

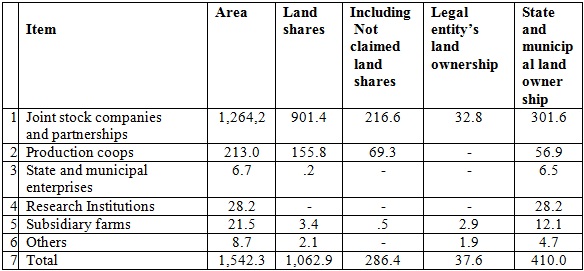

Main role in Orel Oblast Agricultural Land Tenure

play joint stock companies and partnerships or parastatals (see

Table 11). They occupied 1,264.2 (82.0 %) thousand hectares of the

regional agricultural land in 2009. They have also rented the most

of agricultural land shares.

Table 11. Agricultural Land Tenure, Orel

Oblast, 2009, 1000 hectars

Source: Orelnedvizhimost’, 2010.

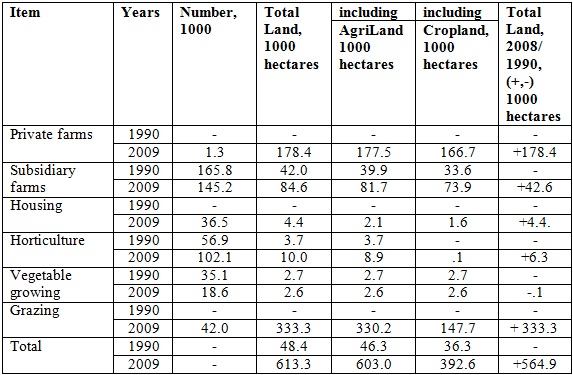

In 2010 there were 1,247 private farms in the region. The average

size of the farm was amounted 142.3 hectares. (See Table 12).

Table 12. Private Agricultural Land Ownership,

Orel Oblast, 1990-2009

Source: Orelnedvizhimost’, 2010.

One of the most important problems of Agricultural Land Market

Development is to create legal as well as institutional framework

for Agricultural Land Mortgage Transactions. In accordance with the

target program “Development of Land Reform in Orel Region for

1999-2002” a new approach for development of Agricultural Land

Mortgage has been introduced. According to the program private farms

as well as other agricultural producers have an opportunity to use

agricultural land as collateral to get loans. According to the

program Agricultural Land Mortgage Obligations should be issued to

develop and stimulate Agricultural Land Market in the region too.

According to 2003 Orel Oblast Agricultural Land Market Act the

regional land market company “Orel Land Investment Company” has been

established. The company operates as an open joint stock

company. In accordance with Orel Regional Government Order # 108

issued on July 22, 2003 the super goal the company is creating of

favorable environment for development of Agricultural Land Market in

Orel Region

Now it’s very important to launch the public

relation campaign focused on Agricultural Land Market Development to

strengthen people’s ability to understand the role and importance of

Agricultural Land Market transactions. Due to it the company

publishes newspaper “Orlovskie zemelnie vedomosti” (Orel Land News)

which provides public access to agricultural land market

transactions as well as agricultural land prices

information.According to article 2 of 2003 Orel Oblast Agricultural

Land Market Act, all agricultural land market transactions must be

executed via Orel Land Investment Company. As a result Orel Oblast

Government Land Policy the efficiency of agricultural production as

well as a number of agricultural land transactions has been

increased in the region (see Table 13).

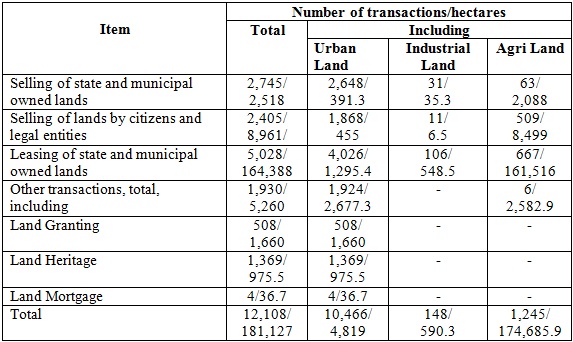

Table 13. Land Market Transactions, Orel Region, 2009

Source: Orelnedvizhimost’, 2010.

As we mentioned before the main role in the regional Agricultural

Land Tenure have played land shares. Most of land share owners have

been officially registered by local authorities. The agricultural

land has been consolidated by purchase or rent of property rights on

land shares belonged to former collective or state farmers by

private farms, parastatals and agricultural holding corporations.

However, agricultural holding corporations have played the dominant

role in this process. In Orel region the agricultural holding

corporations mostly just rent land shares belonged to former

collective or state farmers to expand production scale and increase

regional agricultural production efficiency. In that case the land

shares owners keep their property rights.

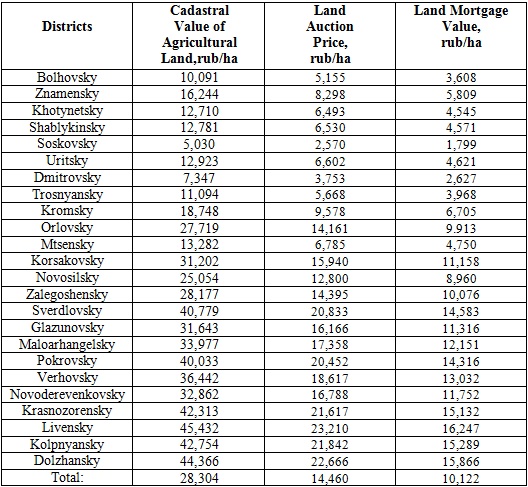

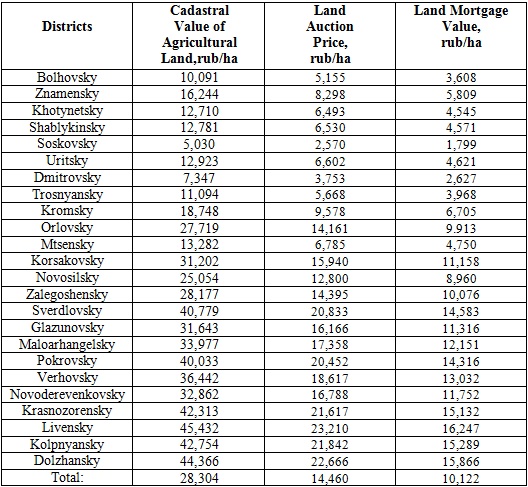

However, Agricultural Land Mortgage System has not developed yet

both on the federal and the regional level. For example there were

just four Land Mortgage Transaction in Orel Region in 2009 (36.7

hectares).In this sense it’s very important to determine

Agricultural Land Mortgage Value based on Agricultural Land Market

Value. Orel Region Districts Agricultural Land Mortgage Values

calculated on the basis of Land Market Auction Price Model are

displayed in Table 14. The Land Market Auction Price Model looks

like:

Va=[

R0(1+g)(1-t)]/{[k(1-at)-g] (1+c)+p(1-t)};

(1)

Where:

Va

-Land Market Auction Price, rubles per hectare;

R0 -Land Rent, rubles per hectare;

g - Land Rent Growth, %;

t - Income Tax, %;

p - Land Tax, %;

k - Interest Rate, %;

c - Transaction Costs;

a - Tax Adjustment Coefficient, calculated as a=R0

(1+g)/ [ R0(1+g) +V1-V0)].

V0 - Cadastral Value of Agricultural Land, rubles per

hectare;

V1 - Cadastral Value of Agricultural Land adjusted for

Land Rent Growth, rubles per hectare.

Land Rent value (R0) was calculated on the base of

cadastral value of agricultural land treated as V0

and official interest rate (3%) used for determination of the value.

Land Rent Growth was estimated 10%.Transaction costs are estimated

as 10% too. Income Tax was taken as official income tax rate

estimated as 20 %.Land Tax was

estimated according to official land tax rate 0.3 % of cadastral

land value. Interest Rate was taken as 15 %.

In general, we can treat the Land Market Auction Price as a ratio

between Land Rent and Interest Rate adjusted for income as well as

land taxation. The ratio between Agricultural Land Market Auction

Price and Agricultural Land Mortgage Value was taken as 70 %. In our

opinion the value should be accepted both the commercial banks and

the agricultural producers.

Table 14. Agricultural Land Mortgage Values, Orel Oblast, 2009

6. CONCLUSION

The following measures must be implemented to strengthen the

organizational as well as institutional sustainability of

Agricultural Land Market in the Russian Federation:

-

Agricultural Land Market Legislation must be revised and amended

both on the federal as well as the regional level.

-

The institutional framework for implementation of Agricultural

Land Market must be improved both on the federal as well as the

regional level too.

-

Agricultural Land Auctions must be introduced to stimulate

development of Agricultural Land Market in the regions of the

Russian Federation.

-

The training and retraining programs related to Agricultural

Land Market issues must be introduced.

-

Real Estate Cadastre Management should be improved in accordance

with market economy standards.

-

The public relation campaign to strengthen people’s ability to

understand the role and importance of Agricultural Land Market

Development must be initiated.

-

Orel Regional Land Policy or Orel Model is one of successful

ways of development of Agricultural Land Market in the Russian

Federation.

-

Orel Oblast Agricultural Land Reform experience should be

scrutinized and replicated in other Russian regions.

REFERENCES

-

Russian National Economy Fact Book 2008 (Rossija v tsifrakh,

2008) Moscow, Federal Service of State Statistics.

-

Russian National Report on Land, Rosnedvizhimost, 2010

-

Orel Oblast Report on Land, Orelnedvizhimost, 2010

BIOGRAPHICAL NOTES

Alexander Sagaydak

D.Sc, Professor of Economics,

Director of Department of Agricultural Economics and Farm

Management,

State University of Land Use Planning, Moscow, Russia

Anna Lukyanchikova

PhD, Assistant Professor of Department of Agricultural Economics and

Farm Management,

State University of Land Use Planning, Moscow, Russia

CONTACTS

State University of Land Use Planning,

15 Kazakova Str., Moscow, 105064, Russia

Tel. +7-499-261-6143

Fax. +7-499- 261-9545

Email: asagaydak@yahoo.com

Web site: www.guz.ru